johnson county kansas vehicle sales tax calculator

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. See how we can help improve your.

Jackson County Mo Property Tax Calculator Smartasset

Vehicle property tax is due annually.

. The current total local sales tax rate in Johnson County TX is 6250. Average Local State Sales Tax. The median property tax on a 20990000 house is 266573 in Johnson County.

The latest sales tax rate for Merriam KS. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. The median property tax on a 20990000 house is 270771 in Kansas.

What you need to know about titling and tagging your vehicle. Vehicle Property Tax Estimator. Kansas State Sales Tax.

Maximum Local Sales Tax. Texas has a 625 sales tax and Johnson County collects an additional NA so the minimum sales tax rate in Johnson County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Johnson. Within Johnson there is 1 zip code with the most populous zip code being 67855.

Just enter the five-digit zip code of the location in which. One of a suite of free online calculators provided by the team at iCalculator. This table shows the total sales tax rates for all cities and towns in.

The total sales tax rate in any given location can be broken down into state county city and special district rates. You pay tax on the sale price of the unit less any trade-in or rebate. This is the total of state and county sales tax rates.

If you have unpaid personal property tax you will be denied vehicle registration until taxes are paid in full. Required if purchased from a licensed Kansas dealer. The total sales tax rate in any given location can be broken down into state county city and special district rates.

US Sales Tax Rates TX Rates Sales Tax Calculator Sales Tax Table. The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county rate 1. This table shows the total sales tax rates for all cities and towns in Wyandotte.

Home Motor Vehicle Sales Tax Calculator. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Johnson County Motor Vehicle PO Box 29192 Shawnee Mission KS 66201 email protected.

US Sales Tax Rates KS Rates Sales Tax Calculator Sales. Wichita KS 67218 Email Sedgwick County Tag Office. You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code.

Personal Property Tax Fees and Payment Options. Kansas has a 65 sales tax and Wyandotte County collects an additional 1 so the minimum sales tax rate in Wyandotte County is 75 not including any city or special district taxes. The 2018 United States Supreme Court decision in.

The average cumulative sales tax rate in Johnson Kansas is 75. For vehicles that are being rented or leased see see taxation of leases and rentals. There are also local taxes up to 1 which will vary depending on region.

One of a suite of free online calculators provided by the team at iCalculator. Johnson County in Kansas has a tax rate of 798 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Johnson County totaling 148. The median property tax on a 20990000 house is 270771 in kansas.

Failure to receive a tax statement does not alleviate a business or individual from interest and fees. The sales tax rate does not vary based on zip code. KSA 8-173 Payments received after the due date are considered late and subject to interest per KSA.

The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county sales tax. Johnson is located within Stanton County Kansas. There is a 30 service charge for each returned check.

This rate includes any state county city and local sales taxes. You cannot register renew or title your vehicle s at the Treasurers office located in the. The Johnson County sales tax rate is 148.

This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases. Please include the vehicle s plate number on the memo line. The Johnson County Sales Tax is collected by the merchant on all qualifying sales made within Johnson County.

For additional information click on the links below. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Kansas has a 65 sales tax and Johnson County collects an additional 1475 so the minimum sales tax rate in Johnson County is 7975 not including any city or special district taxes. Motor vehicle titling and registration.

KS is in Johnson County. Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including. Personal checks should include a valid drivers license and daytime phone number.

The Kansas state sales tax rate is currently 65. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Mail checks to Johnson County Treasurer at the Motor Vehicle Mailing Address.

2020 rates included for use while preparing your income tax deduction. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. There may be additional sales tax based on the city of purchase or residence.

The sales tax in Sedgwick County is. Maximum Possible Sales Tax. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

Johnson County collects a 1475 local sales tax the maximum local. The December 2020 total local sales tax rate was also 6250. This includes the sales tax rates on the state county city and special levels.

The Johnson County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Johnson County Kansas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Johnson County Kansas. You can also mail envelopes to Johnson County Motor Vehicle at 6000 Lamar Ave Mission KS 66202. The median property tax on a 20990000 house is 220395 in the United States.

Subtract these values if any from the sale. You may write one check to pay for multiple vehicles. The minimum combined 2022 sales tax rate for Johnson County Kansas is 948.

The total sales tax rate in any given location can be broken down into state county city and special district rates. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Historical South Dakota Tax Policy Information Ballotpedia

Missouri Sales Tax Rates By City County 2022

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

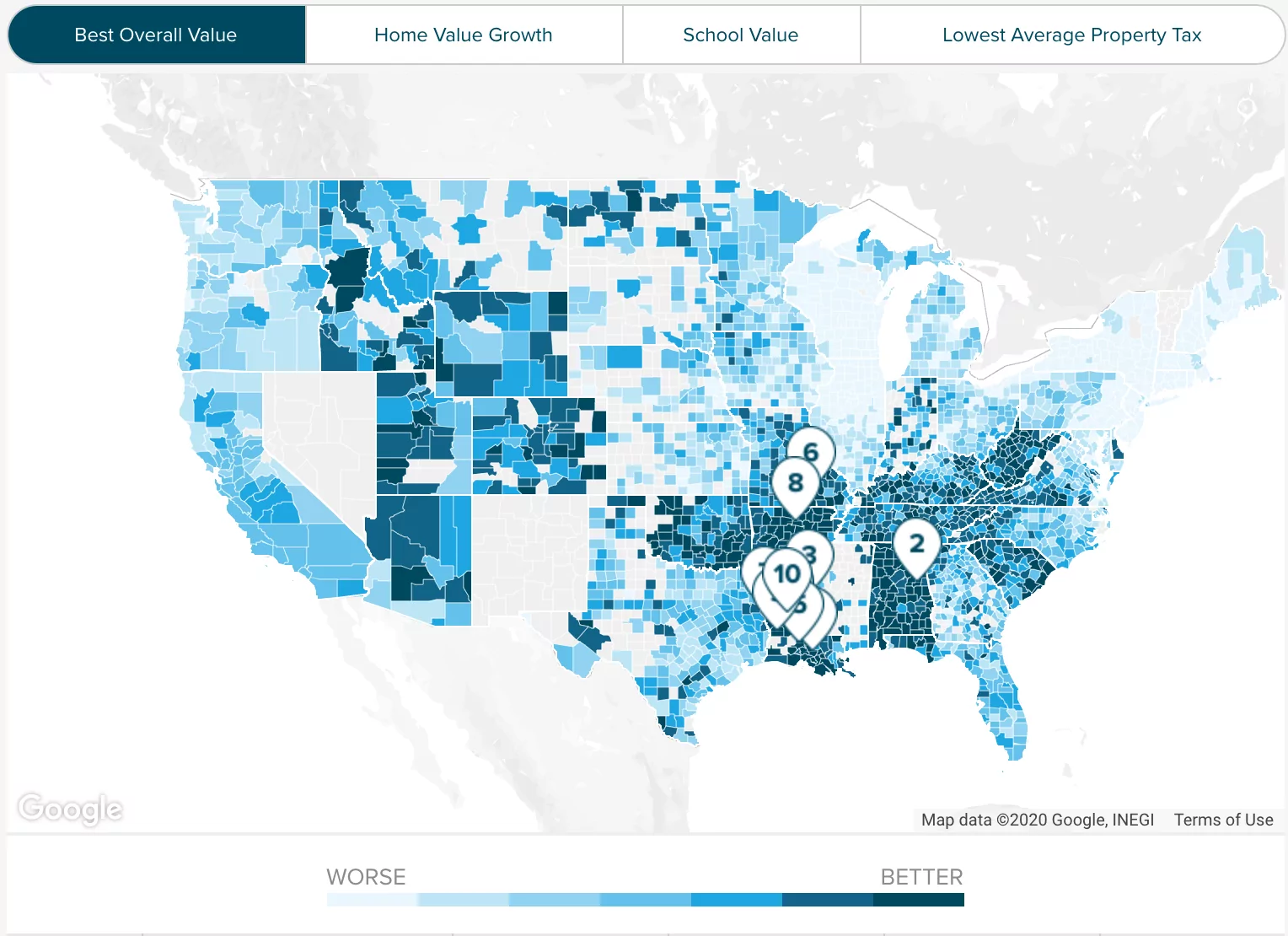

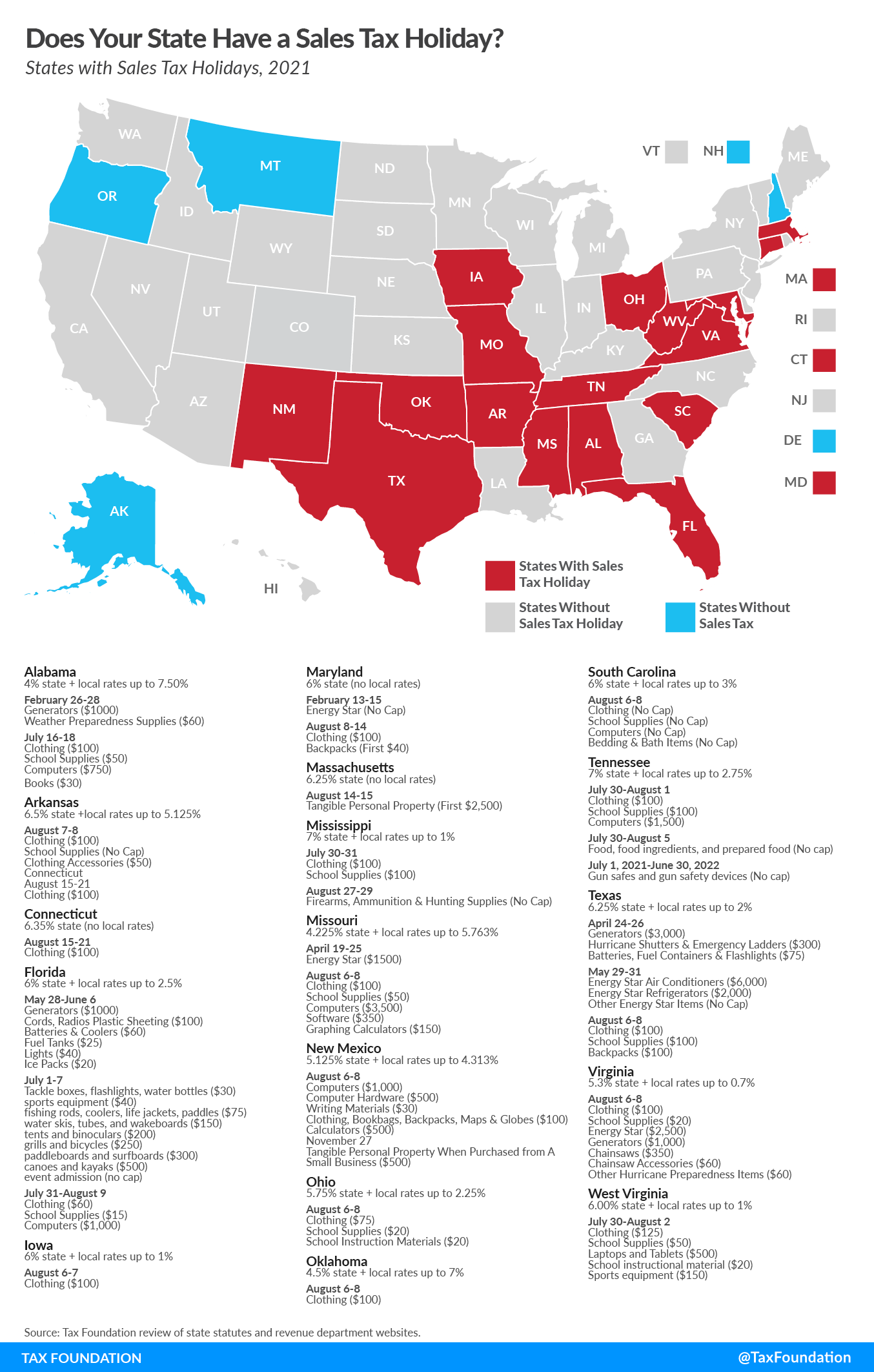

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Maintaining Merriam City Of Merriam

What Is The Sales Tax In Arkansas See The Sales Tax Rate In All 75 Counties

Kentucky Property Tax Calculator Smartasset

Motor Vehicle Fees And Payment Options Johnson County Kansas

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Missouri Car Sales Tax Calculator

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Holidays Politically Expedient But Poor Tax Policy

States With Highest And Lowest Sales Tax Rates

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975